Business Insurance in and around Orland Park

Get your Orland Park business covered, right here!

Almost 100 years of helping small businesses

- Orland Park

- Tinley Park

- Mokena

- New Lenox

- Homer Glen

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to keep track of. You're not alone. State Farm agent Scott Neil is a business owner, too. Let Scott Neil help you make sure that your business is properly insured. You won't regret it!

Get your Orland Park business covered, right here!

Almost 100 years of helping small businesses

Protect Your Future With State Farm

State Farm has been helping small businesses grow since 1935. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are an optician or a fence contractor or you own a hobby shop or a meat or seafood market. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Scott Neil. Scott Neil is the agent who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

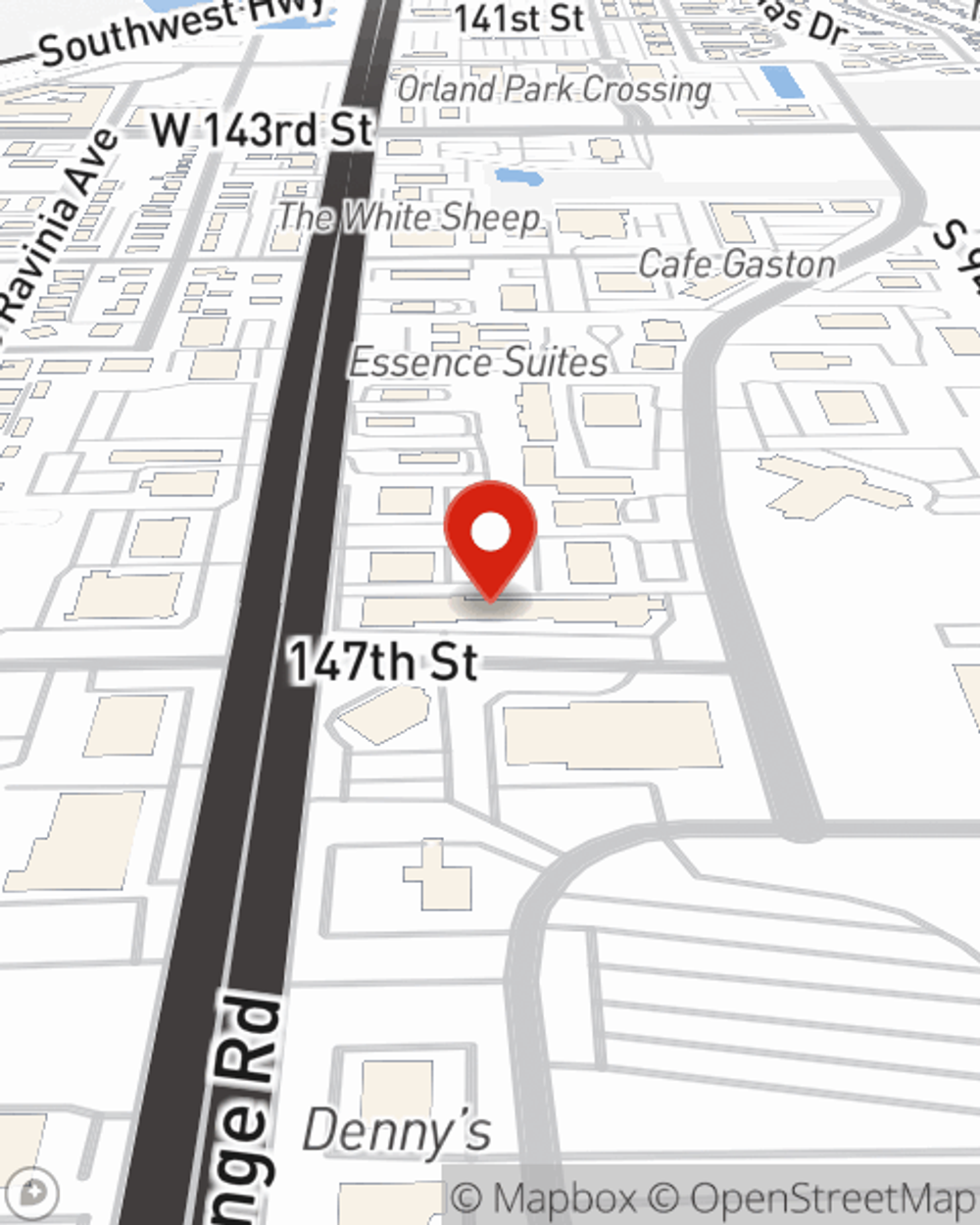

Visit State Farm agent Scott Neil today to check out how one of the leaders in small business insurance can safeguard your future here in Orland Park, IL.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Scott Neil

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".